Advisory

Supporting your clients with Funding Options: webinar overview

8 Sept 2020

Our Head of Advisory Partnerships Katie Ball and Head of Sales Ryan Hyde-Smith took to Funding Options’ virtual stage recently to talk about market trends and how we work with our introducers. The webinar is intended for existing and prospective introducers, as well as anyone interested in the market and how we operate.

Click here to watch the webinar:

An “introducer” is anyone who refers clients to us; they form part of our Advisory channel which is one of our highest performing. We want to ensure that we optimise the channel so we can continue to provide the level of service our introducers and their clients expect. SMEs need our support more than ever and we’re very much open for business.

You can watch the webinar above and reach Katie Ball at [email protected] / 0203 389 7186 if you have any questions relating to partnerships.

Webinar highlights

Funding Options

Funding Options is the UK’s leading marketplace for business finance. We work with over 200 lenders in the market, from high street banks to alternative finance providers. Our breadth of expertise means we’re able to source finance and funding for a variety of purposes through an array of products.

Every funding request we receive is managed by one of our Business Finance Specialists.

Our introducers

The Advisory channel incorporates accountants, brokers, financial advisors, consultants and other professionals. We’ve onboarded a lot of new partners and lenders over the past few months to make sure that we’re able to assist adversely affected SMEs.

Revenue Share Scheme

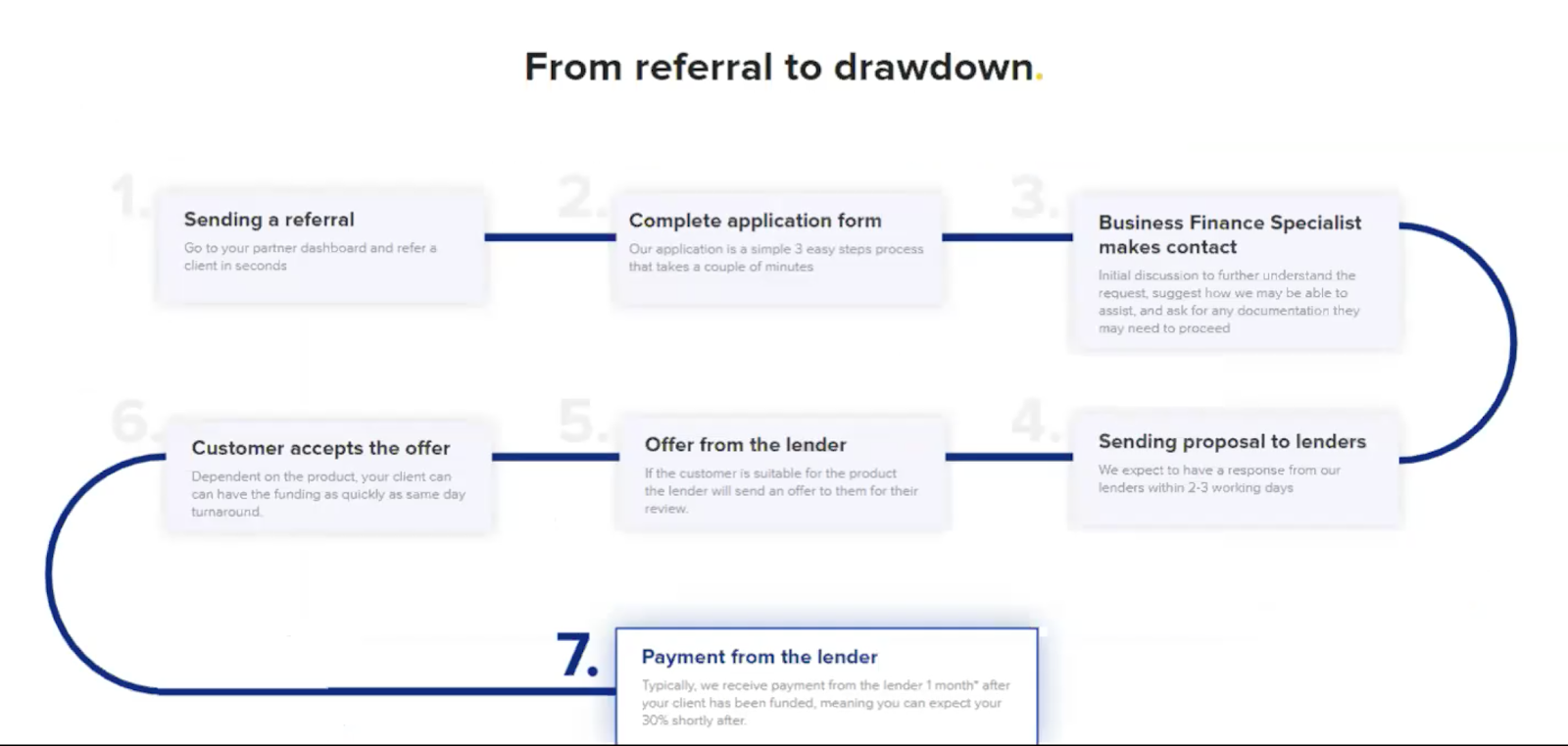

Funding Options’ introducers receive a 30% revenue share of any deal that is successful. That’s 30% of the fee that Funding Options receives from the lender.

The lender fee is typically around 4% (although it varies from product to lender). So, if a client receives £75,000, Funding Options would receive £3,000 and the introducer would receive £900. The 30% figure is currently fixed across all introducers. There’s no minimum commitment when it comes to introducing clients.

Once an introducer is onboarded, they have access to their own personal dashboard which displays a summary of all existing referrals and the stage/ status of each.

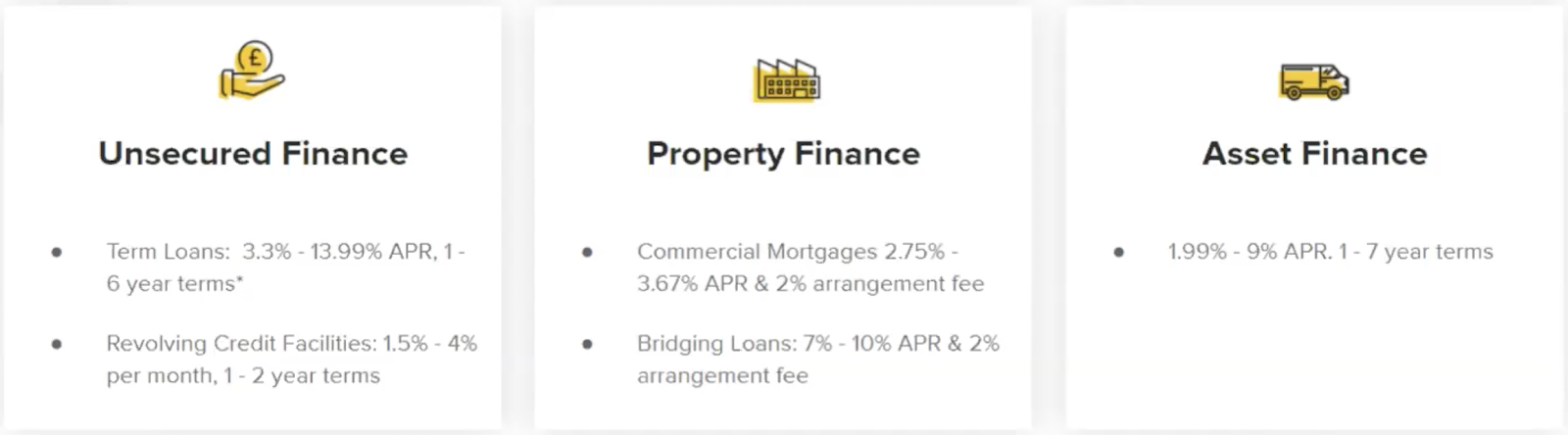

Types of finance

Unsecured term loans

Business credit cards

Overdraft facilities

Asset finance

Invoice finance

Property finance

Merchant cash advances

CBILS

We are currently unable to assist with Bounce Back Loans. This facility is largely not on offer in the alternative finance market because it is easy to access from high street banks.

Market trends

We’re seeing some stability return as the economy reopens, more businesses resume trade and the government broadens its lending schemes, including the Coronavirus Business Interruption Loan Scheme (CBILS) and the Bounce Back Loans (BBL).

According to the British Business Bank (BBB), over 20% of UK SMEs have access to Bounce Back Loans, however less than 1% have had access to a CBILS facility. Bounce Back Loans involve a self-certification and the approval rate sits at around 90%, but CBILS undergoes a strict underwriting process and has an approval rate of just below 50%.

Outside of CBILS, we’re beginning to witness green shoots of recovery both on the lender and customer request side. The number of applications and funded customers outside of the CBILS is also increasing month-on-month.

Finance Types

*For CBILS facilities, all lender fees and the first 12 months of interest is paid by the government.

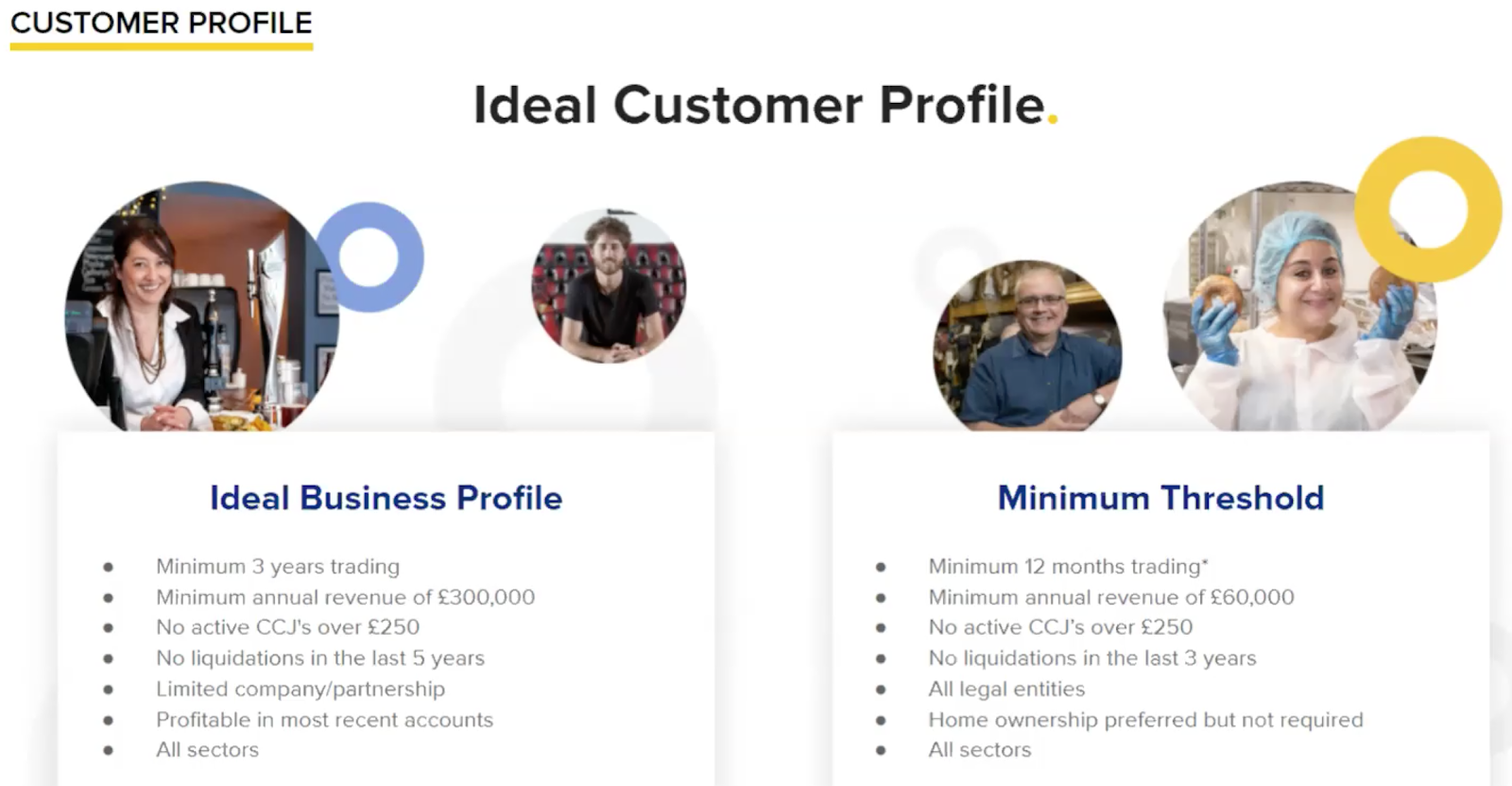

Ideal Customer Profile vs Minimum Threshold

How Referrals Work

*For CBILS, lenders receive their percentage from the British Business Bank on a quarterly basis so introducers can expect to receive their fee four months from the funding being accessed.

You can watch the webinar in full here.

Subscribe to our newsletter today

Sign up for the best of Funding Options sent straight to your inbox.